Technology

Advanced Semiconductor Market Share by Country (2023-2027F)

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Advanced Semiconductor Market Share by Country (2023-2027F)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In today’s fast-changing tech landscape, advanced semiconductors drive innovation across industries, powering devices from smartphones to healthcare equipment.

In this graphic, we visualize advanced foundry capacity by country, for 2023 and forecasts for 2027. This data comes from TrendForce, and was published in December 2023.

Advanced vs. Mature Processes

Advanced manufacturing processes refer to ≤16/14 nanometer (nm) nodes. Smaller transistors allow manufacturers to pack more of them onto a single chip, increasing processing power and efficiency.

For example, the iPhone 15 Pro uses Apple’s first chip manufactured with a 3 nm process, while the Playstation 5 uses a 6 nm chip.

Mature processes (28 nm or larger) are cheaper to produce and are used in products that don’t require significant computing power. This includes home appliances and fitness trackers.

Taiwan Still #1 for Foreseeable Future

Taiwan holds 68% of advanced foundry capacity, though this is expected to fall to 60% by 2027 as the U.S. expands its domestic capacity. Taiwanese TSMC tops the list of the largest producer of advanced semiconductors. The company earned 60% (or nearly $17 billion) of semiconductor foundry revenue in Q1 2023.

Japan is also getting into the mix, with Rapidus Corp. aiming to produce 2 nm chips by 2027.

| Country | 2023 Market Share (%) | 2027F Market Share (%) |

|---|---|---|

| 🇹🇼 Taiwan | 68 | 60 |

| 🇰🇷 Korea | 12 | 13 |

| 🇺🇸 U.S. | 12 | 17 |

| 🇯🇵 Japan | 0 | 4 |

| 🇨🇳 China | 8 | 6 |

U.S. share of advanced process capacity is expected to increase from 12% to 17% by 2027, although over half of this capacity will come from foreign companies operating in the U.S., such as Samsung or TSMC.

Meanwhile, in response to export controls on advanced chip making equipment by the U.S., China is focusing on mature processes. China’s mature process capacity is set to grow from 31% to 39% by 2027.

Technology

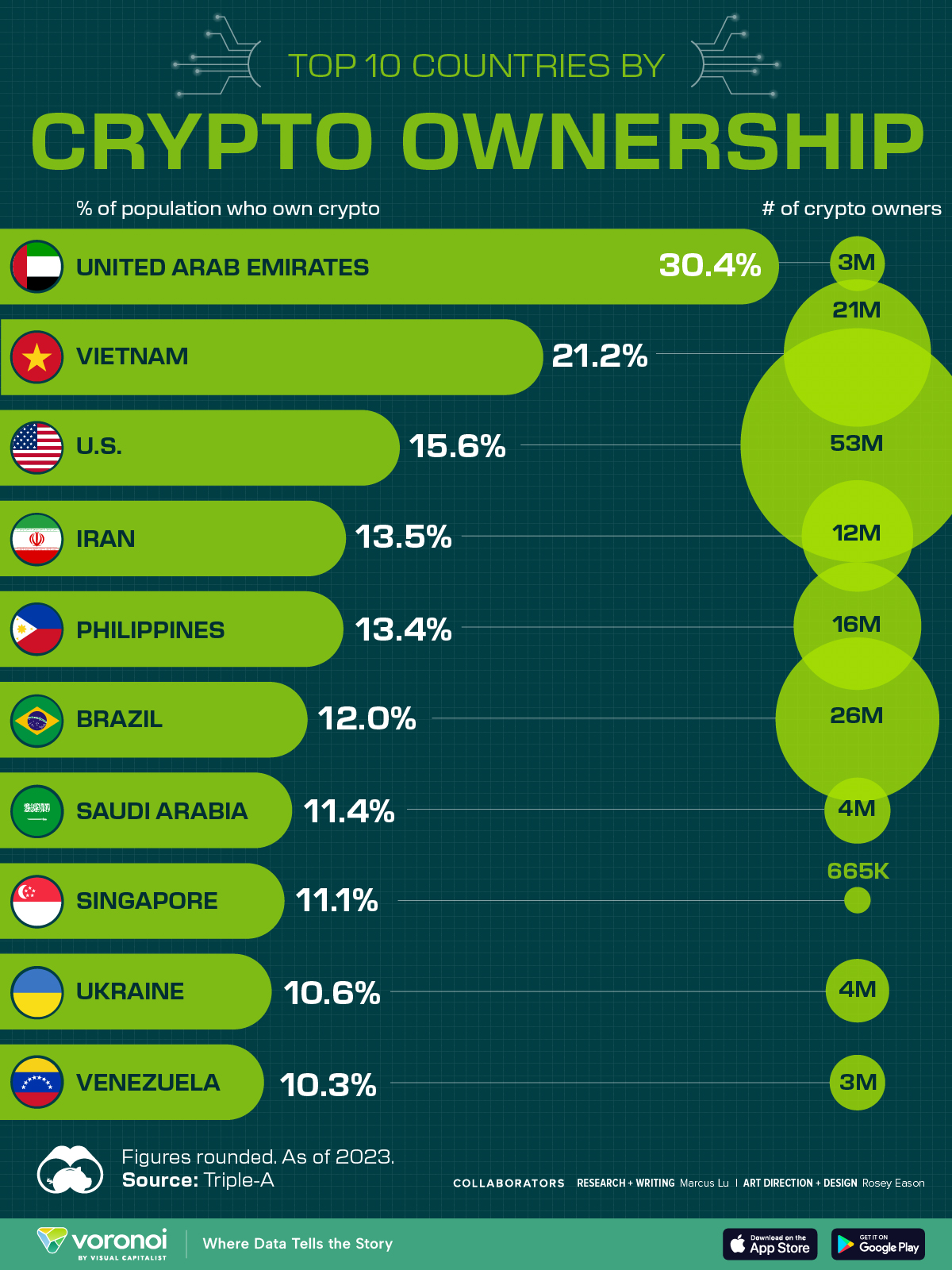

Countries With the Highest Rates of Crypto Ownership

While the U.S. is a major market for cryptocurrencies, two countries surpass it in terms of their rates of crypto ownership.

Countries With the Highest Rates of Crypto Ownership

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This graphic ranks the top 10 countries by their rate of cryptocurrency ownership, which is the percentage of the population that owns crypto. These figures come from crypto payment gateway, Triple-A, and are as of 2023.

Data and Highlights

The table below lists the rates of crypto ownership in the top 10 countries, as well as the number of people this amounts to.

| Country | % of Population Who Own Crypto | # of Crypto Owners |

|---|---|---|

| 🇦🇪 United Arab Emirates | 30.4 | 3M |

| 🇻🇳 Vietnam | 21.2 | 21M |

| 🇺🇸 U.S. | 15.6 | 53M |

| 🇮🇷 Iran | 13.5 | 12M |

| 🇵🇭 Philippines | 13.4 | 16M |

| 🇧🇷 Brazil | 12 | 26M |

| 🇸🇦 Saudi Arabia | 11.4 | 4M |

| 🇸🇬 Singapore | 11.1 | 665K |

| 🇺🇦 Ukraine | 10.6 | 4M |

| 🇻🇪 Venezuela | 10.3 | 3M |

Note that if we were to rank countries based on their actual number of crypto owners, India would rank first at 93 million people, China would rank second at 59 million people, and the U.S. would rank third at 52 million people.

The UAE Takes the Top Spot

The United Arab Emirates (UAE) boasts the highest rates of crypto ownership globally. The country’s government is considered to be very crypto friendly, as described in Henley & Partners’ Crypto Wealth Report 2023:

In the UAE, the Financial Services Regulatory Authority (FSRA-ADGM) was the first to provide rules and regulations regarding cryptocurrency purchasing and selling. The Emirates are generally very open to new technologies and have proposed zero taxes for crypto owners and businesses.

Vietnam leads Southeast Asia

According to the Crypto Council for Innovation, cryptocurrency holdings in Vietnam are also untaxed, making them an attractive asset.

Another reason for Vietnam’s high rates of ownership could be its large unbanked population (people without access to financial services). Cryptocurrencies may provide an alternative means of accessing these services without relying on traditional banks.

Learn More About Crypto From Visual Capitalist

If you enjoyed this post, be sure to check out The World’s Largest Corporate Holders of Bitcoin, which ranks the top 12 publicly traded companies by their Bitcoin holdings.

-

Brands5 days ago

Brands5 days agoThe Evolution of U.S. Beer Logos

-

Culture2 weeks ago

Culture2 weeks agoThe World’s Top Media Franchises by All-Time Revenue

-

voronoi2 weeks ago

voronoi2 weeks agoBest Visualizations of April on the Voronoi App

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which Country Has the Most Billionaires in 2024?

-

Business1 week ago

Business1 week agoThe Top Private Equity Firms by Country

-

Markets1 week ago

Markets1 week agoThe Best U.S. Companies to Work for According to LinkedIn

-

Economy1 week ago

Economy1 week agoRanked: The Top 20 Countries in Debt to China

-

Politics1 week ago

Politics1 week agoCharted: Trust in Government Institutions by G7 Countries